Solar panel houses are one of the most sought-after forms of alternative energy. These homes are great for reducing your electricity bill, while also being environmentally friendly. These solar minigrids can be used to help make your community more energy-efficient. If you are planning to build a solar panel house, here are some tips to help you get started. Solar panels may qualify for a tax credit. These are the three main benefits of solar panel houses.

Solar panels at a cost

There are many good reasons to install a sunroof on your house. This energy source can save you a lot of money on your electric bills. It's also great for the environment, and you'll enjoy a lower carbon footprint. These are some of the factors to consider before you decide to put solar panels on your rooftop. To determine how much electricity your house uses monthly, you will need to establish the following information. It's also important to identify the type and age of your roof.

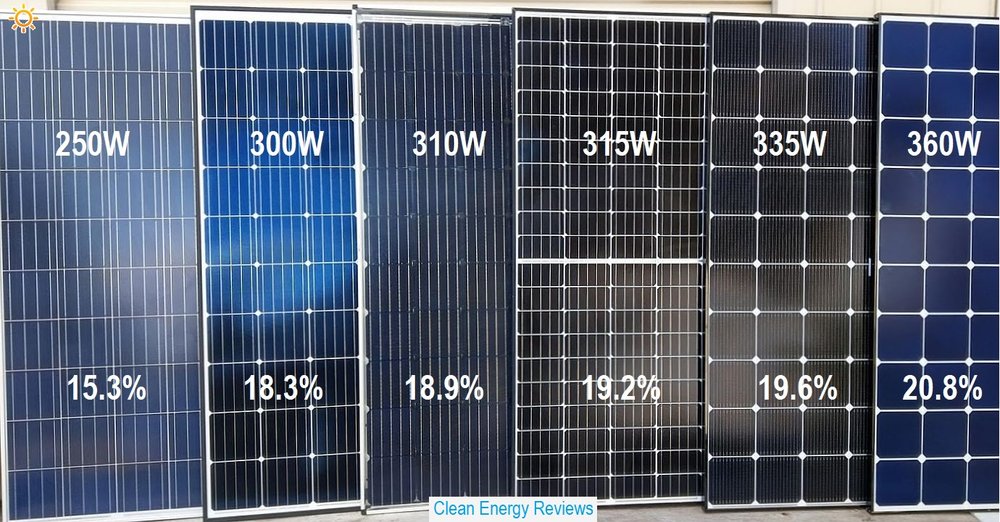

Solar panels cost per watt vary widely. The average residential 5kW system costs between $3 and $5 per watt. The cost of a watt varies greatly by region. New England is the most expensive and the Southern United States the least. Keep in mind that costs can vary from one state to the next. Before making a purchase, it is a good idea to compare the prices and benefits. After all, the return on your investment is a big factor!

Maintenance costs for solar panels

It is essential to check the health of your solar cells on a regular basis. It doesn't take much to check the solar panels. A walk around your home every week is enough. Check for any signs of damage, and report them if you find any. The manufacturer of your panels should be able to provide you with a warranty. If not, you'll have to pay for cleaning. Some warranty packages cover cleaning, repairs, and electrical system checkups.

Cleaning is another important task. Your panels should be cleaned at least twice per year. Even the smallest amount can accumulate over time and rain can't take it all. It's worth hiring professionals to inspect and clean your solar panels. These services can be very cost-effective. This is the best way for you to protect your investment. Just remember to keep track of how much energy you generate each week - any dramatic changes should signal a problem.

Tax benefits of installing solar panels

The government offers tax benefits for homeowners who install solar panels in their homes. This tax credit is available to certain households and can be used for the installation of solar panels on a primary residence or second home. The credit is good for one year after the installation of solar panels is completed. The tax credit does NOT cover roof repairs, and may be limited by federal taxes owed. If you have solar panels that will be used in the future, your tax benefits may be carried forward into future years. Taxpayers should keep all receipts and certification statements.

The 30% ITC applies for new residential solar panels installed between January 1, 2006. and December 31, 2020. The credit will decrease to 22% by 2021 and expire eventually. In 2025 however, the ITC is set to expire. This means that residential solar systems are no longer eligible for the federal credits. It's a good idea now to install solar panels on houses in order to take advantage of the tax credit.